Simply hours earlier than the discharge of the Federal Reserve’s newest fee resolution, contemporary inflation information confirmed that value will increase slowed notably in Could.

The brand new report is an indication that inflation is cooling once more after proving sticky early in 2024, and it might assist to tell Fed officers as they set out a future path for rates of interest. Policymakers had embraced a fast slowdown in value will increase in 2023, however have turned extra cautious after inflation progress stalled early this 12 months. The newest information might assist to revive their conviction that inflation is within the technique of returning to the central financial institution’s purpose.

Right here’s what to know:

-

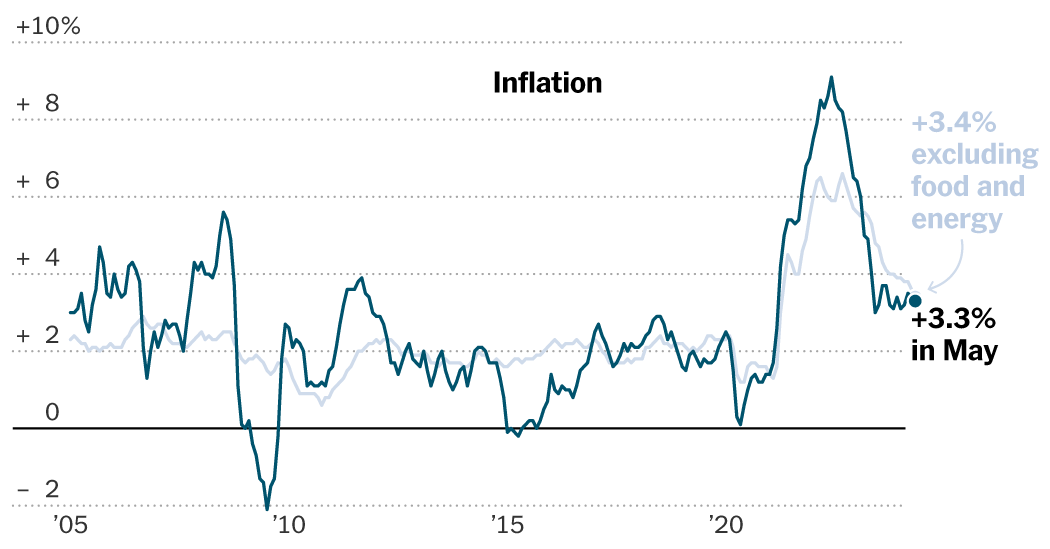

General inflation cooled: The Client Value Index for Could was up 3.3 p.c from a 12 months earlier, decrease than the three.4 p.c economists had forecast and down from the April studying. And for those who in contrast Could costs simply to the earlier month, they didn’t climb in any respect.

-

“Core” inflation additionally slowed: A carefully watched measure that strips out risky meals and gasoline costs to present a way of the underlying pattern climbed 3.4 p.c from a 12 months earlier, down from 3.6 p.c the earlier month and slower than economists had forecast. That was the slowest tempo of improve since April 2021.

-

This might be a giant deal for the Fed. Central bankers will launch their fee resolution at 2 p.m., and whereas they’re extensively anticipated to go away rates of interest unchanged this month, the contemporary inflation information might feed into what they mission for the remainder of the 12 months. Policymakers will publish their first financial forecasts since March alongside their coverage assertion. This report might assist pave the best way to earlier rate of interest cuts.

-

What economists are saying: “That is sort of nice, however it’s one month,” stated Michael Feroli, chief U.S. economist at J.P. Morgan. He stated that the Fed is unlikely to chop rates of interest this summer time on the premise of simply this inflation report. He expects a November fee lower, however following Wednesday’s report he might see a case for September. “This positively suits with the ‘bumps within the street’ narrative,” he stated, explaining that the early 2024 inflation stubbornness now seems like much less of an enduring situation.

-

Inflation is down sharply from its peak. Whereas right this moment’s inflation fee is quicker than the two p.c that was regular earlier than the pandemic, it’s a lot slower than the 9.1 p.c that general inflation reached in 2022. The Fed goals for two p.c inflation, although it defines that measure utilizing the Private Consumption Expenditures index. Information from the C.P.I. launch feeds into that report, which comes out with extra of a delay — not till June 28 this month.

-

The place is the cool-down coming from? Automotive insurance coverage value will increase stunned economists by slowing sharply final month from April, and resort and flight costs were cheaper. Lease inflation stays cussed, however forecasters count on it to start slowing quickly. Attire costs declined on a month-to-month foundation, and grocery inflation was average.